The Euro (EUR) extended upside movement against the US Dollar (USD) on Monday, increasing the price of EUR/USD to more than 1.0700 ahead of the ECB’s head Mario Draghi’s speach. The technical bias remains bearish because of a lower high in the recent upside rally.

How to Trade today’s Draghi Speach?

- Buying EUR/USD put options above the aforementioned support levels can be a good strategy if Draghi paints unfavorable picture about the Eurozone’s economy.

- Alternatively, buying EUR/USD call options above the aforementioned resistance levels can be a good strategy if he hints at potential rate hike in coming months.

ECB’s Mario Draghi Speach

The European Central Bank (ECB) head Mario Draghi is due to speak today during the US trading session. The ECB president is expected to share key information about the future monetary policy outlook of the European Union (EU). Investors will be monitoring Draghi’s remarks very closely, a hawkish stance shall lead to sharp rally in the EUR/USD pair and vice versa.

Technical Analysis

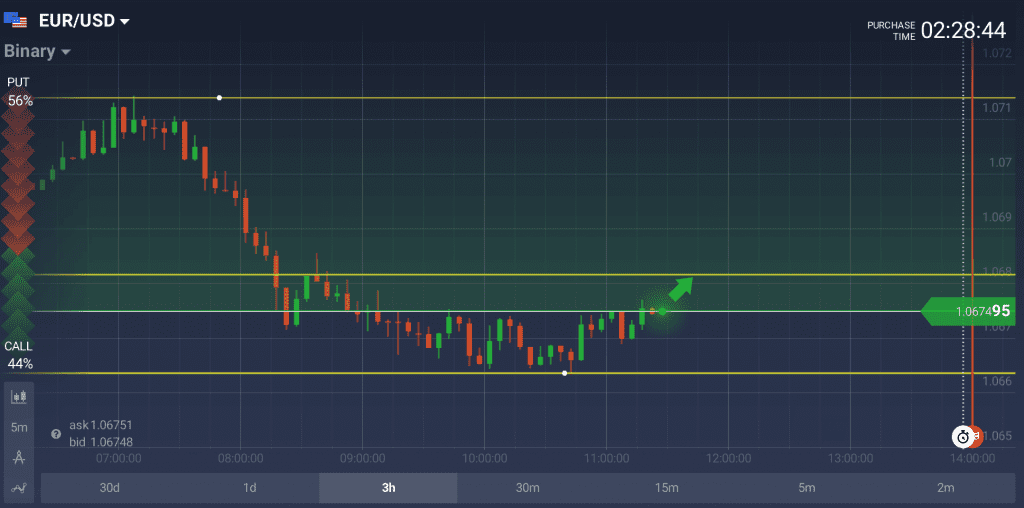

As of this writing, the pair is being traded around 1.0701. A support may be seen near 1.0618, the trendline support area as demonstrated in the given below daily chart with brown color. A break and daily closing below the 1.0618 trendline support shall incite renewed selling interest, validating a move towards the 1.0400 support zone which is a psychological number.

On the upside, the pair is expected to face a hurdle near 1.0710, the 38.2% fib level ahead of 1.0819, the 50% fib level and then 1.0990, the upper trendline resistance as marked with red color in the above chart. The technical bias shall remain bearish as long as the 1.0819 resistance zone is intact.

How EUR/USD Reacted to Draghi speeches In Past?

The EUR/USD rallied last week after the ECB’s head Mario Draghi remarks as he painted a very positive picture about the Eurozone economy. He said the painful monetary policy instruments adopted by his team are finally showing the desired outcomes.

The pair however fell sharply after the Draghi’s speech on February 6th, 2017 after he said the central bank might go for more harsh monetary policy tools including the negative benchmark interest rate.

No comments:

Post a Comment